Difference Between Takaful And Conventional Insurance In Urdu

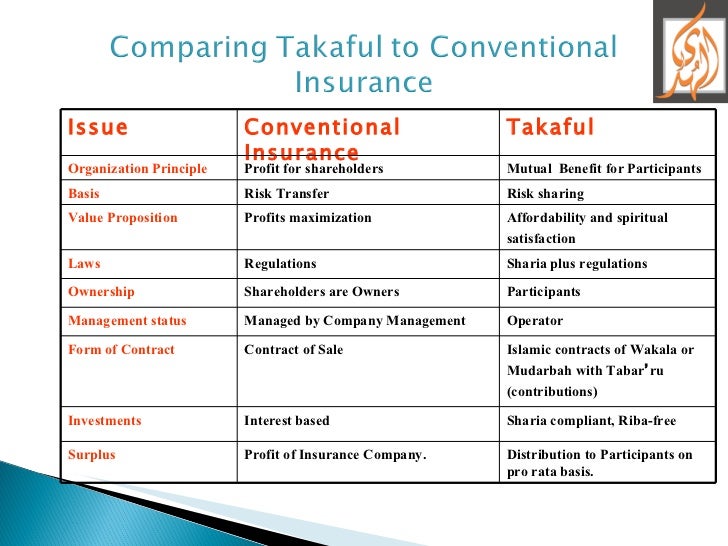

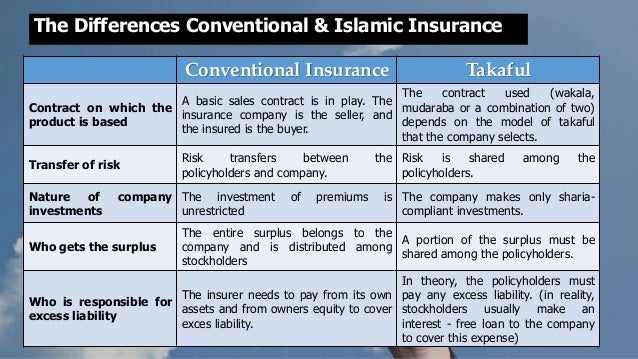

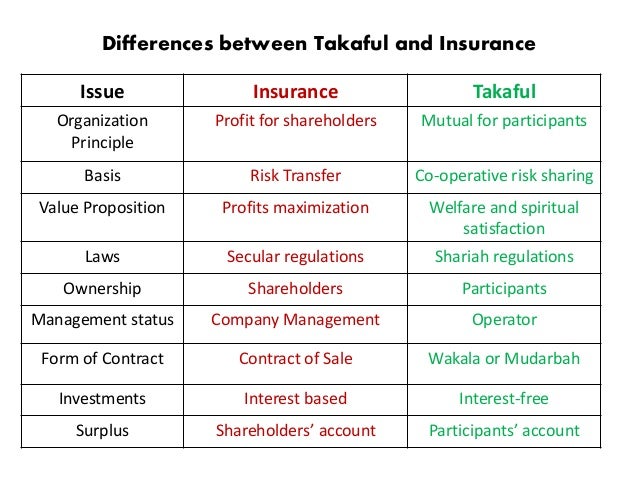

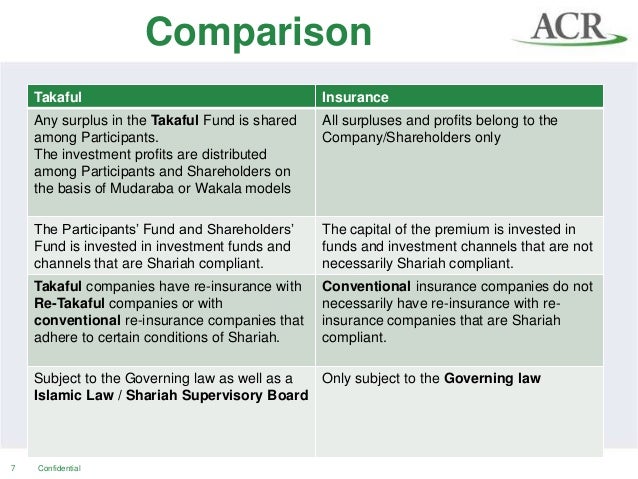

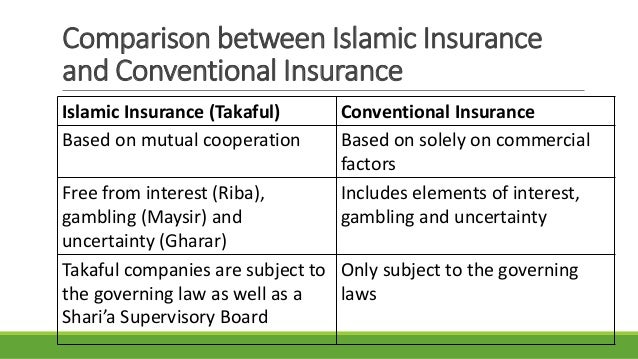

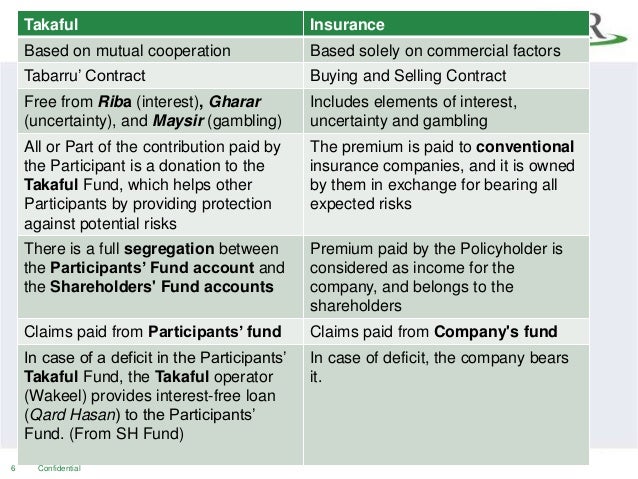

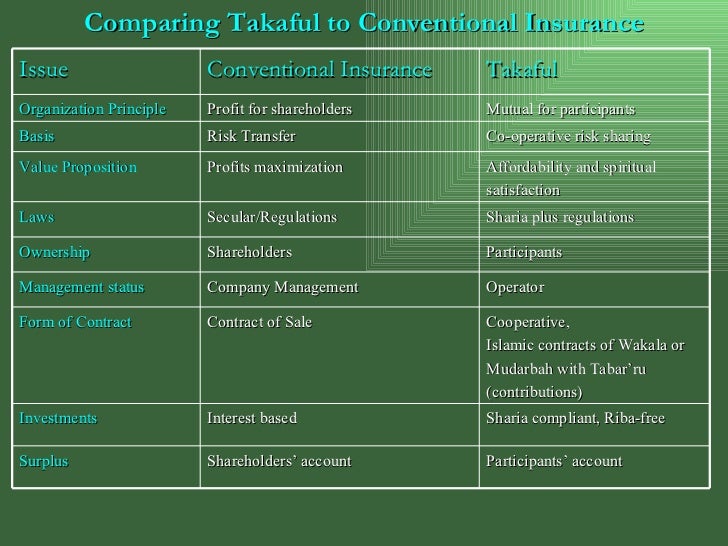

The following table summarizes the main differences between both systems.

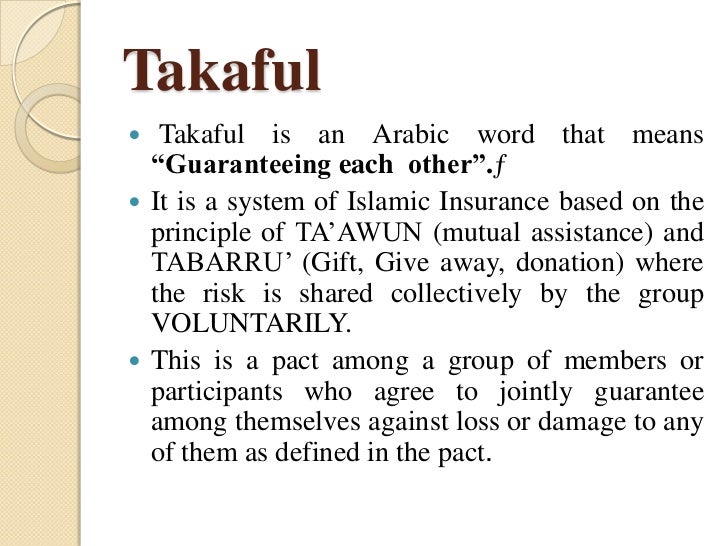

Difference between takaful and conventional insurance in urdu. For customers i would say. In arabic takaful means guaranteeing each other and so takaful insurance is an islamic insurance theory that is compliant with islamic law sharia and is a mutual risk transfer arrangement which involves operators. Hence it obviates the element of maisir while at the same time without losing the benefit of takaful in the same way as conventional insurance. Having said that there are major differences in the workings of the two systems stemming from the fact that takaful adheres strictly to the islamic principles it was developed upon.

Takaful is another name of islamic insurance that allows the premiums received from insured to be pooled into a fund to support each other in case someone gets any damage. Takaful vs conventional insurance. Conventional insurance involves the elements of excessive uncertainty gharar in the contract of insurance. Difference between conventional insurance and takaful.

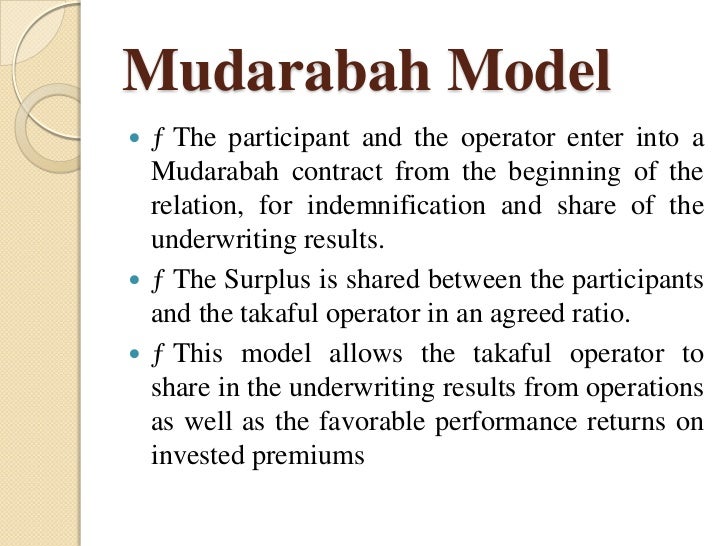

This is because takaful fund rates are generally fixed and people deemed to carry extra risk aren t typically charged more unless in severe situations that would cause losses to the entire fund. Central ideas and general principle islamic insurance is operation based on al mudharabah financing which is interest free while in conventional insurance it is based on the principle. This difference can be analyzed under central ideas and general principles external factors essential components and contractual factors. Takaful is definitely not islamic insurance and should never be referred to as such.

Basically whoever invented takaful 30 or 40 years ago took conventional insurance infused it with al gharar and then called the product islamic. The difference between takaful and conventional life insurance. There are differences between islamic and conventional insurance. 4 funds are only invested in non interest bearing i e.

Is takaful or conventional insurance cheaper. Although both conventional and takaful businesses generate profits for the shareholders in takaful business the expenses paid to the shareholders are explicitly transparent in conventional insurance they are not necessarily so. Takaful insurance is a form of co operative insurance in compliance with islamic shariah which is based on the concept of shared contributions and mutual co operation between the participants to compensate one another in case of loss. The key difference between takaful and conventional insurance rests in the way the risk is assessed and handled as well as how the takaful fund is managed.

One isn t necessarily cheaper than the other but in terms of extra risk premiums takaful insurance may be better in terms of cost. Although essentially both takaful and conventional life insurance serves the same purpose of providing coverage there are major differences between the two as can be seen below.